The Hidden Impact of Brazil’s New Ad Tax on Meta Ad Margins

Brazil’s latest tax reform is sending shockwaves through the digital advertising world, and many advertisers didn’t see this coming. Starting January 1, 2026, running Meta ads in Brazil will quietly become more expensive.

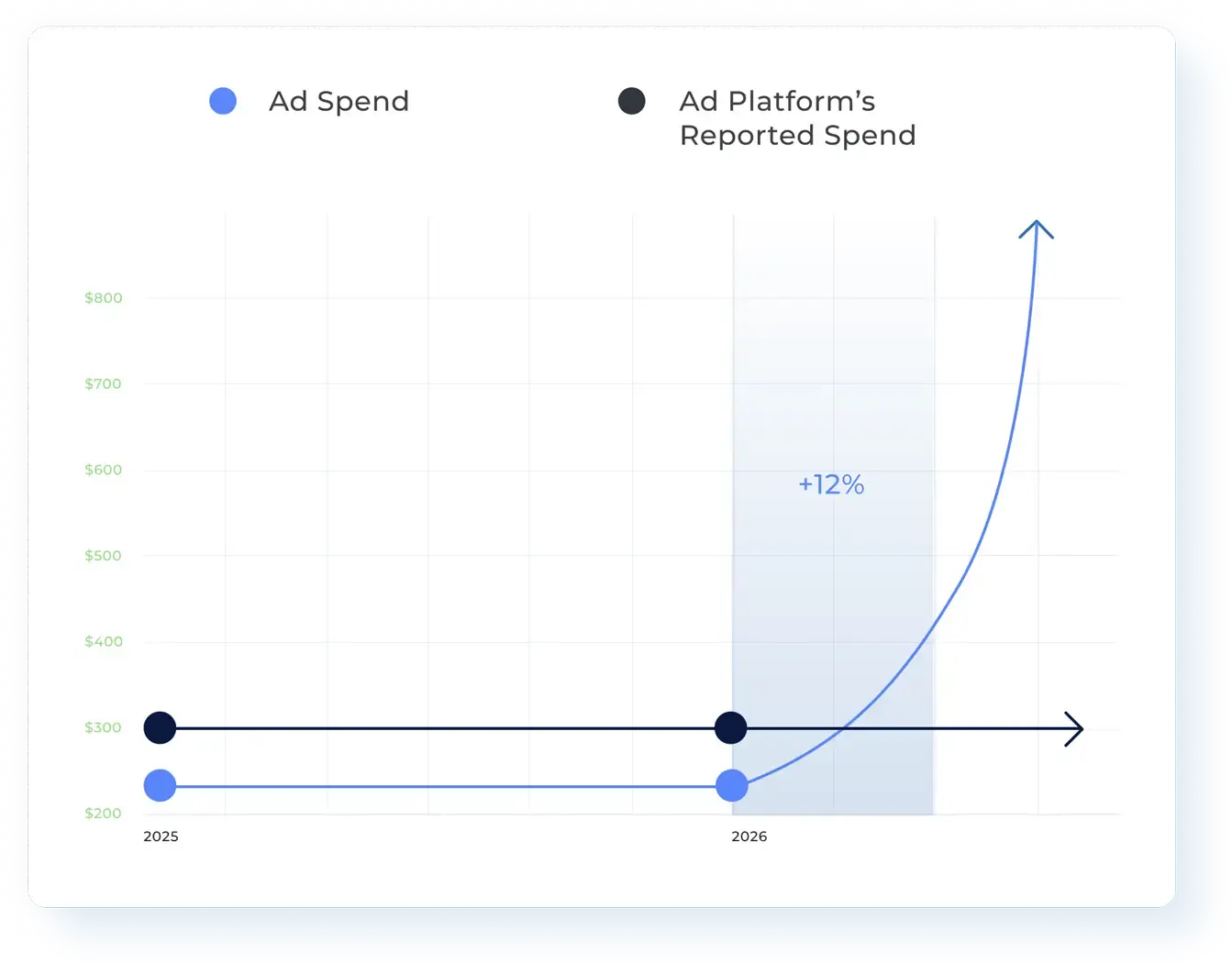

A new rule adds over 12% in extra costs to Facebook and Instagram ads, without changing anything you see inside Ads Manager. CPMs look the same. ROAS looks the same. But behind the scenes, profit margins shrink. This is exactly why many advertisers feel something is “off” but can’t see why. The issue isn’t creative or targeting, it’s how ad spend is structured and billed. And for everyone doing media buying, it’s a clear signal that ad infrastructure matters more than ever.

Brazil’s “Invisible” Ad Tax: A 12% Cost Increase Hiding in Plain Sight

Starting in 2026, advertising on Meta in Brazil will become more expensive. Brazil is changing how digital services are taxed, and Meta is updating how it bills advertisers as a result. Until now, Meta was covering certain local taxes itself. Going forward, those taxes will be added directly to advertisers’ bills. The result is straightforward: running Facebook and Instagram ads in Brazil will cost roughly 12% more, even though nothing changes inside Ads Manager. These indirect taxes (9.25% and 2.9% respectively) sum to approximately 12.15%. In practical terms, campaigns in Brazil will cost about 12% more starting in 2026.

Critically, Meta’s invoices will now include the ad spend plus a line for taxes, whereas before, taxes were an internal cost. For Brazilian advertisers billed by Meta’s local entity, this change instantly raises the price of advertising. Larger companies may partially recover these taxes later as credits, but many businesses (e.g. those under simplified regimes) cannot, which means the 12% is a direct hit to their costs.

What You Don’t See in Ads Manager Is Costing You Money

The most troubling aspect is how invisible this cost surge is in day-to-day campaign monitoring. Meta clarified that in Ads Manager “the total spent will be equivalent to the campaign budget and not include taxes”. In other words, your ad dashboard will continue to show the same spend, cost-per-click, CPM, and ROAS as before – as if nothing changed. The +12% tax will only show on the billing invoice (or payment receipt) after the fact.

For example, an advertiser might budget R$1000 for a campaign and see exactly R$1000 spent in Ads Manager, with performance metrics looking normal. But the invoice will total ~R$1,121.5 once taxes are added. That extra R$121.5 is effectively lost margin: an “invisible tax” that doesn’t appear in Facebook’s performance reports. Advertisers who don’t actively reconcile invoices could easily overlook why their marketing ROI shrank.

It’s entirely possible for an ad campaign to perform as well as before, yet generate 12% less margin, which is a fact hidden from view unless you catch the billing line items.

Operational and Financial Challenges Post-Tax Change

The tax change doesn’t just affect profit on paper. It affects how campaigns actually run. Advertisers now need to plan budgets differently to avoid problems. If you use postpaid billing, you’ll need to allow for extra budget on top of your ad spend, otherwise campaigns may stop earlier than expected. If you use prepaid billing, your balance will simply run out faster, because part of it now goes to taxes instead of ads. Either way, the same thing happens: you get less advertising for the same money.

You would think that such changes force marketers and finance teams to recalculate KPIs and targets. Marketing budgets might need a 12% boost just to maintain the same media output, or else expectations for results must be scaled down. Pricing strategies could be revisited to pass on some costs to consumers.

There’s also a compliance and cash flow aspect. With taxes itemized, advertisers need to properly account for them in their books (and potentially claim credits if eligible). Payment cycles might tighten if invoices swell. Those on credit terms with Meta will owe 12% more each cycle, which can impact cash flow and credit limits. Small businesses not used to dealing with VAT-like issues now face a more complex billing reality. All these adjustments are not advertising problems per se, but operational ones stemming from a policy change.

Beyond Brazil: A Wake-Up Call for Infrastructure Investment

While our focus is Brazil, the lesson is universal. Similar “silent killers” can strike in any market, whether through new digital taxes, sudden currency shifts, or platform policy changes that alter fees. The Brazil case is a vivid reminder that advertising success isn’t just about creative and targeting. It depends heavily on the infrastructure and systems supporting your ad spend. As Meta’s ecosystem evolves (with stricter verification, privacy changes, etc.), we’re seeing a split in the industry: “those who have the right infrastructure, and those still trying to improvise around its limits.”

The advertisers who handle changes like this best are the ones with solid systems in place. If you’re managing everything manually, using different tools that don’t talk to each other, or only checking costs at the end of the month, it’s easy to miss problems. A billing change can slowly eat into profit without anyone noticing, and an account shutdown can stop campaigns instantly. Advertisers who invest in better infrastructure don’t panic when this happens. They see issues early, adjust budgets quickly, and keep campaigns running without disruption.

In short, the Brazil tax change is a wake-up call. It’s telling everyone that “performance marketing” isn’t just what happens in the ad auction; it’s also what happens in your billing department, your business manager structure, and your integration with platforms. To protect margins and scale efficiently, you need to fortify these behind-the-scenes layers. This is where solutions like AdForce come into play.

Why Some Advertisers Use AdForce by Coinis

Enter AdForce, not just a workaround for Brazil’s tax issue, but a strategic infrastructure platform designed for the new era of advertising. AdForce was built in collaboration with Meta’s advanced Business Manager program to give agencies and advertisers an enterprise-grade foundation for their campaigns. It addresses the very pain points highlighted by the Brazil case study, by providing an integrated system for ad accounts, billing, and real-time oversight. Instead of reacting to every platform change, AdForce users operate with a higher level of control and visibility from day one.

How AdForce Strengthens Ad Operations: AdForce supports advertisers by simplifying how campaigns, spend, and accounts are managed across Meta. The points below outline where it has the biggest practical impact.

- Stronger Account Trust & Stability: All ad accounts run under one verified, compliant umbrella, dramatically reducing random bans or restrictions. By operating on “verified ground” with compliance at the core, advertisers improve their account trust scores and avoid costly downtime. Fewer shutdowns and payment issues mean more consistent performance and preserved client trust.

- Faster Scaling with Automated Account Creation: Need new ad accounts or Business Managers? AdForce automates that process through system-managed Child Business Manager (CBM) creation. Users can “request verified Business Managers directly through the platform, eliminating days of waiting or manual setup. This allows rapid scaling into new accounts or markets, all under a governed structure. While you can increase spend without hitting the usual roadblocks.

- Full Cost Visibility (Post-Tax & Post-Credit): AdForce provides transparent, real-time spend visibility across all your campaigns and accounts. Unlike a standard Ads Manager, it’s built to show the true cost picture: including any taxes, fees, or credit adjustments, in one dashboard. Advertisers can model their spend in real time and immediately see the impact of external cost factors. This kind of insight lets you adjust for things like Brazil’s tax within your bidding and budgeting strategy, ensuring there are no end-of-month surprises.

- Centralized Billing and Credit Management: Instead of paying for each ad account separately, AdForce puts all billing in one place. You add funds once and spread them across all your ad accounts as needed. This makes it easier to manage budgets, gives you more control over cash flow, and reduces payment issues..

- Unified Multi-Account Control: Managing dozens of accounts and campaigns becomes far easier when “every team member, asset, and transaction lives in one ecosystem – visible, accountable, and compliant.” AdForce’s interface lets you oversee multiple Business Managers, ad accounts, Pages, and Pixels from a single control center. You can filter and organize by client, region, or any label, and enforce consistent best practices across all. This multi-account command center is crucial when a policy change (like a new tax) needs to be communicated and applied across campaigns instantly.

- Seeing What You Actually Earn: Because all spend and costs are visible in one place, advertisers can clearly see how changes like taxes or fees affect profitability. This makes it easier to spot margin pressure early and understand where it comes from, instead of discovering it weeks later in financial reports. The result is better control over profitability, even when external costs change.

Collectively, these capabilities turn advertising infrastructure into a competitive advantage. In a landscape where most are busy reacting to platform changes, AdForce users are proactively managing risk, efficiency, and scale. One can think of it this way: instead of just running ads, you’re running a well-oiled ad machine, one that factors in legal, financial, and technical realities automatically, so you can focus on strategy and creative execution.

Moreover, AdForce is not a static solution; it’s part of a larger innovation roadmap at Coinis. The platform is continually evolving, with new features and integrations being added. It’s built on Meta’s latest API infrastructure with a close partnership, meaning AdForce stays aligned with Meta’s policies and capabilities, keeping its users a step ahead.

Curious how AdForce works? Book a free 30-minute consultation.

The Bigger Lesson Behind the Tax Change

Brazil’s new tax rule is a prime example of how unseen operational changes can silently drain advertising profits. While many will initially treat it as an anomaly (or misattribute it to their campaign tactics), the truth is clear: the back end matters. Advertisers who invest in sturdy, centralized infrastructure will navigate such changes far more smoothly than those who don’t.

It’s not just the ad creative, audience targeting, or bid strategy that determine success. It’s also the architecture of accounts, billing, and data that underpins your entire operation. By fortifying that foundation, you protect your margins and set your team up to scale faster, even in challenging, regulated markets.

AdForce is one solution leading this charge. It illustrates how an infrastructure-first approach can turn a potential 12% loss into a non-event, by making costs fully visible, ensuring compliance, and giving you tools to respond instantly. Billing-layer changes no longer have to catch you off guard or eat into your profits. With the right systems in place, you can treat them as just another variable in the model, one you’re fully equipped to manage.

In the end, the advertisers who will win in 2026 and beyond are those who pair great creative and strategy with resilient infrastructure. The Brazil case study may be about taxes, but it’s really about preparedness. Don’t let “invisible” costs stay invisible: shine a light on them with better tools, and turn what could have been a margin killer into merely a line item you’ve already accounted for.