Why Meta Ads Are More Expensive in 2026

Meta’s advertising costs are increasing as we enter 2026, and direct-to-consumer (DTC) brands, performance marketers, and performance media buyers are feeling the burden. If you’ve been scaling Facebook and Instagram ads internally, you’ve likely noticed a steady uptick in CPMs and CPA over the past few years. In fact, recent data shows Facebook’s average cost per lead climbed 21% year-over-year (YoY) in 2025, and Meta itself reported a 14% jump in ad costs against only a 6% increase in impressions.

The result? Advertisers are paying more to reach the same audiences, and ROI is harder to come by. This blog breaks down why Meta ads have become more expensive in 2026 and what’s driving these rising costs on a global scale. We’ll explore five key factors behind the trend:

- Ad Saturation and Smarter Competition: A crowded marketplace and AI-driven bidding are pushing prices up.

- Data Loss from Privacy Laws: New privacy regulations and tracking limits mean weaker targeting and higher effective costs.

- Platform-Side Billing & Policy Changes: Meta’s own changes (from fees to ad policies) are adding hidden costs and complexities.

- Inefficient Ad Infrastructure & Media Buying: Poor account setups, overlaps, or tech gaps can silently drain your budget.

- Misattribution, Creative Testing Loops & MarData Blind Spots, Testing Inefficiencies & Misaligned Metricsgin Misdiagnosis: Gaps in tracking and focus on wrong metrics lead to wasted spend and wrong decisions.

Throughout, we’ll also touch on how modern ad infrastructure (for example, AdForce by Coinis) is emerging as a crucial way to manage these challenges: helping brands scale efficiently, maintain spend visibility, and avoid hidden costs. Let’s dive into each factor and unpack what’s happening, using simple language and clear examples (with minimal jargon).

Ad Costs Are Up: More Brands, Smarter Algorithms

Every time you run a Meta ad, you’re entering an auction. And in 2026, these auctions are more competitive than ever. More advertisers are competing for the same eyeballs, and they’re using advanced tools to bid smarter. The result is auction inflation: higher clearing prices for ad placements across Facebook, Instagram, and other Meta properties.

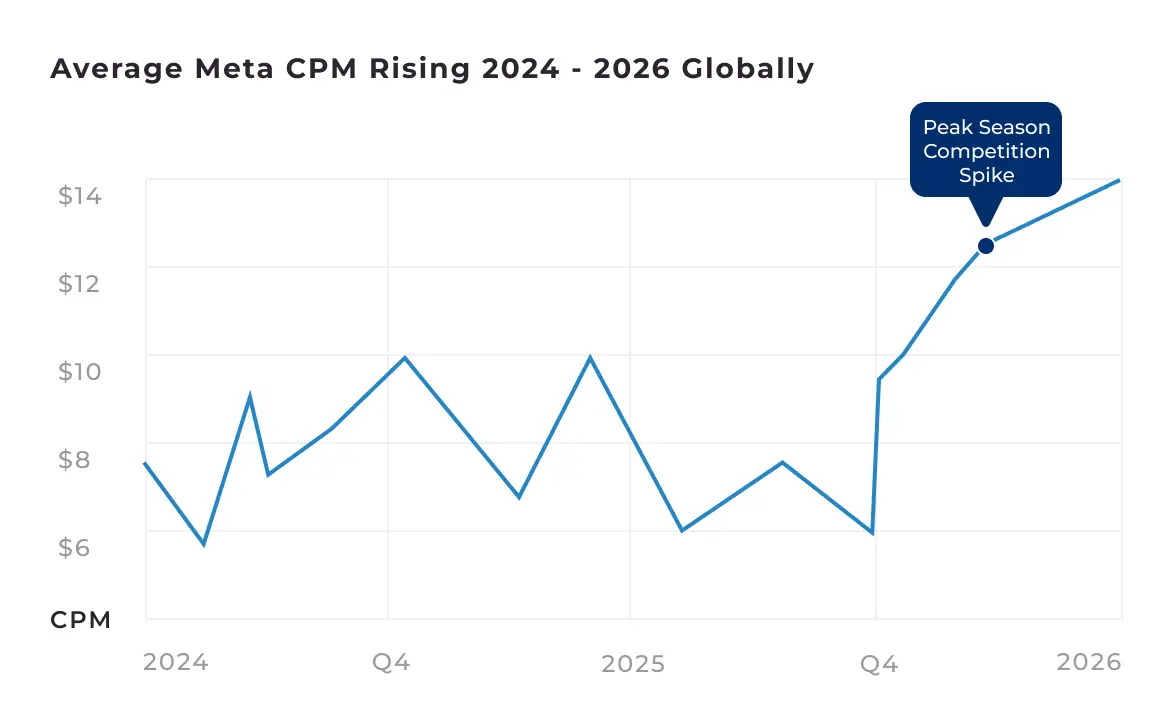

Rising Demand, Higher CPMs: Digital ad spend keeps growing each year, and social advertising is no exception. During big shopping seasons or global events, this trend is amplified. For example, in the 2025 holiday period, advertisers saw CPMs spike by as much as 66% in key e-commerce categories as competition peaked. It’s not just a seasonal thing: Meta’s average ad prices have been rising year-over-year. Insider forecasts noted that CPM prices are up across all major social networks, including Meta, partly because advertisers are paying for more efficient ad products. In Q2 2025, Instagram’s average CPM hit $9.46 (surpassing Facebook’s CPM), showing how demand for Meta’s prime placements (like Instagram feeds and Stories) is driving costs higher.

Smarter Competition: It’s not merely more bidders in the auction, it’s that bidders have become smarter and more sophisticated. Today’s performance marketers leverage AI-driven campaign optimizations and better data insights to maximize results. Meta’s own algorithms (e.g. Advantage+ campaigns) use machine learning to find the most valuable users, which means advertisers can achieve better outcomes but often end up bidding more aggressively for those high-value clicks. In effect, AI-powered ad offerings are helping advertisers get better targeting and outcomes, which justifies higher bids and CPMs. Competitors armed with advanced tools can afford to pay more per impression because they squeeze more revenue out of each ad. As one report summarized, social networks are increasing ad rates as they sell the promise of AI-driven results. But these improvements don’t benefit everyone equally. Some search arbitrage advertisers, for instance, have raised concerns about Advantage+ placements appearing in lower-quality inventory, including traffic placements flagged as spammy by certain feed providers. They’re calling for more control over where ads appear, especially when automation overrides manual exclusions.

Fighting for Finite Attention: The pool of user attention isn’t growing as fast as advertiser demand. Facebook’s user base and ad inventory have grown, but not at the pace of ad budgets. Meta’s user growth was around 5%, while Wall Street expects 20%+ revenue growth, and that gap is essentially filled by higher prices. It’s a bidding war for high-intent buyers. As more businesses fight for the same audience in a crowded digital landscape, advertising costs climb for everyone. This is especially true for direct-to-consumer brands that all target similar demographics (e.g. young adults interested in health, beauty, tech, etc.). If 10 competitors are targeting the same “beauty trend enthusiasts” in the US, Meta’s auction will make them bid up the price to win impressions. In markets worldwide, as digital adoption grows, local Direct-to-Customer brands are also jumping into Meta ads, further increasing competition for regional audiences.

Auction pressure is the foundational reason Meta ads cost more in 2026. There are simply more advertisers with bigger budgets, and they’re using smarter tactics. This inflation means brands must outsmart rather than outspend. The winners are those who maximize every dollar (through better creative and targeting efficiency) instead of blindly throwing more money into bids. In this high-stakes auction environment, having the right tools and data (for example, using an advanced platform like AdForce to manage spend) can be the difference between profitable scaling and overspending.

Privacy Rules Are Breaking Your Targeting

The data landscape for digital advertising has dramatically shifted in recent years. Privacy laws and tracking restrictions have cut off many of the signals that Meta’s ad targeting and attribution relied on. For advertisers, this data loss means less precision, and when you can’t precisely target or measure, you often end up paying more to reach the right customers.

The Post-Privacy Era: Several major changes have unfolded globally: regulations like the EU’s GDPR and California’s privacy laws now restrict how user data is collected and used. Apple’s App Tracking Transparency (ATT) on iOS (introduced in 2021) was a game-changer. It let users opt out of tracking, causing a large drop in data available for Meta to attribute conversions and optimize ads. By now, most iOS users have opted out, and other platforms (Android, browsers like Chrome with cookie deprecation by 2024/25) are following suit. Platforms and regulators are cracking down on tracking, leading to what some call the “cookiepocalypse” for digital ads.

Why this raises costs: Meta’s ad system historically thrived on rich data, knowing who clicked, who converted, which sites you visited, etc. With less of that data, the platform’s targeting is less laser-focused. Ads are shown to a broader audience or with less optimization, meaning more waste. You might have to spend extra budget to find the right customer who previously could be pinpointed easily. As one AdExchanger analysis put it, if ad targeting is less effective, costs will increase for advertisers (while performance for each ad impression drops). We’re seeing that play out: privacy rules are indeed squeezing advertisers. Marketers report that after Apple’s changes, ROAS plummeted and cost per lead skyrocketed in many cases, not necessarily because ads stopped working, but because it’s harder to track and target the people who do convert.

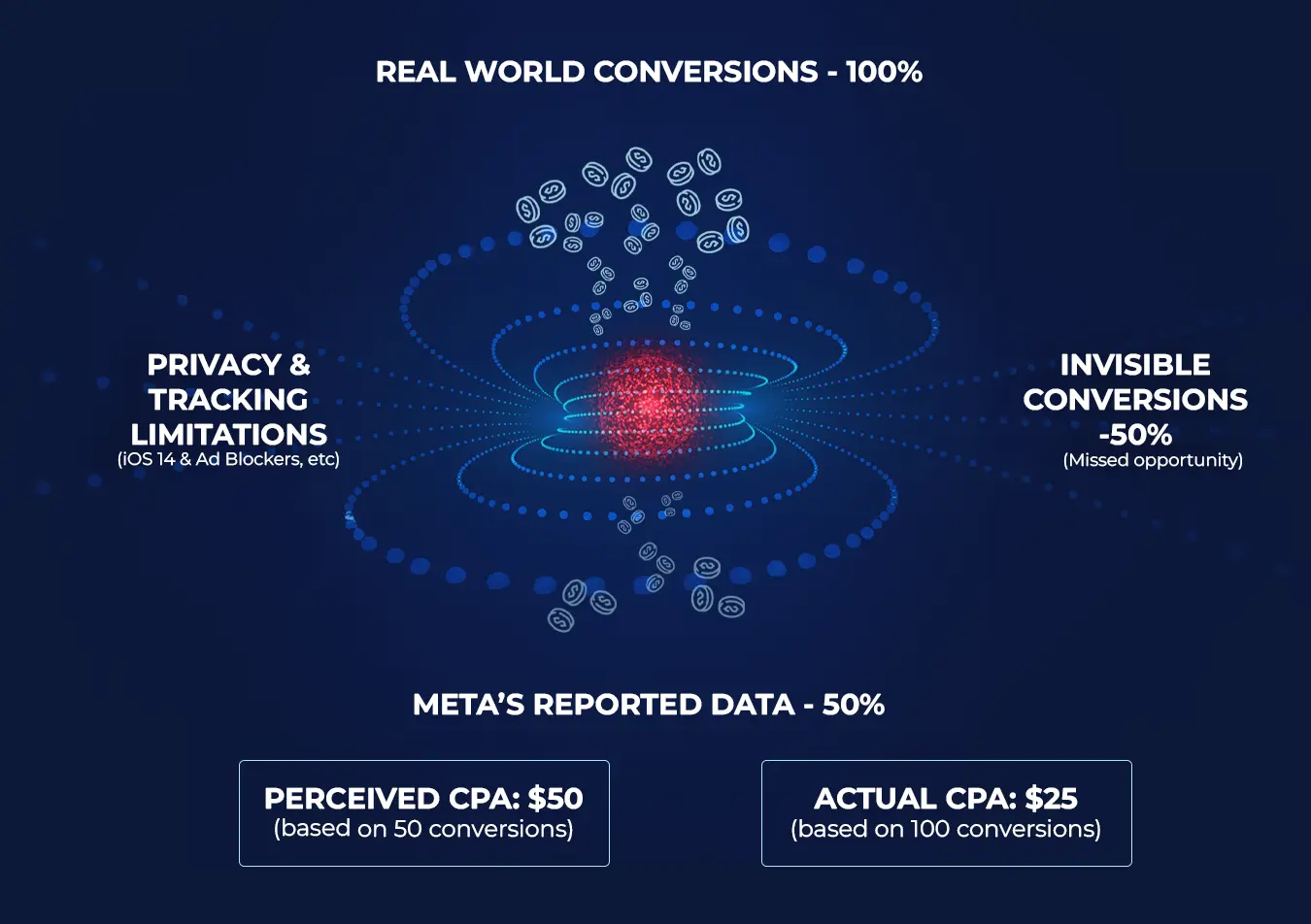

When You Can’t Track, You Overspend: Another aspect is misattribution due to privacy (we’ll dive deeper into attribution later). Because Meta can’t see all the conversions, it often under-reports results. Advertisers then face a dilemma: either trust that some conversions are happening untracked (and keep spending) or cut budgets prematurely. Many became cautious and “paid more for less visible results,” essentially making Facebook ads look more expensive per conversion than they truly were. For instance, one agency noted that early on, they had to spend more time and money to “glean learnings” on performance post-iOS14 because the platform no longer showed which ads worked as clearly. This learning tax increases the effective cost of advertising.

The end of hyper-targeting: In 2026, the days of micro-targeting specific user traits on Meta are largely over. Meta has removed many granular targeting options (e.g. sensitive interest categories) due to privacy and policy reasons. Combined with less third-party data, advertisers must lean into broader targeting and algorithmic audience finding. Broad targeting can work, but it often means your ads initially show to some people who aren’t ideal (until the algorithm “learns”). That learning period is essentially spent budget. As Meta’s 2025 policy shifts kicked in, marketers have had to accept that hyper-specific audience carving is fading, and success now relies on creative and upper-funnel strategies to attract the right users. In practice, that might mean a higher CPA until your broad campaign optimizes, whereas before you might have run a tightly targeted campaign that was efficient from day one.

Data and privacy changes have effectively made Meta ads less efficient and more costly for the same results. With less precise targeting, you either spend more to reach the right people or accept higher CPAs. With weaker attribution, you risk allocating budget poorly (possibly cutting good campaigns or continuing bad ones). All of this contributes to the feeling (and reality) that “Facebook ads aren’t as cheap as they used to be.” Smart advertisers are adapting by embracing new measurement solutions (like conversion APIs, first-party data, or third-party attribution tools) and focusing on creative quality to do the heavy lifting. In this environment, having a robust infrastructure (for example, AdForce’s unified reporting, book a demo with me and let me show you ey) can help brands consolidate data sources and preserve as much visibility as possible, reducing the cost impact of data loss.

Why Your Invoice Is Bigger Than Your Ad Spend

Not all cost increases come from auctions and algorithms, some are built into the system by design or policy. Meta’s own platform changes can introduce new fees, taxes, or rules that make advertising more expensive or less efficient if you’re not prepared. In 2026, advertisers need to watch for these “hidden” or structural costs.

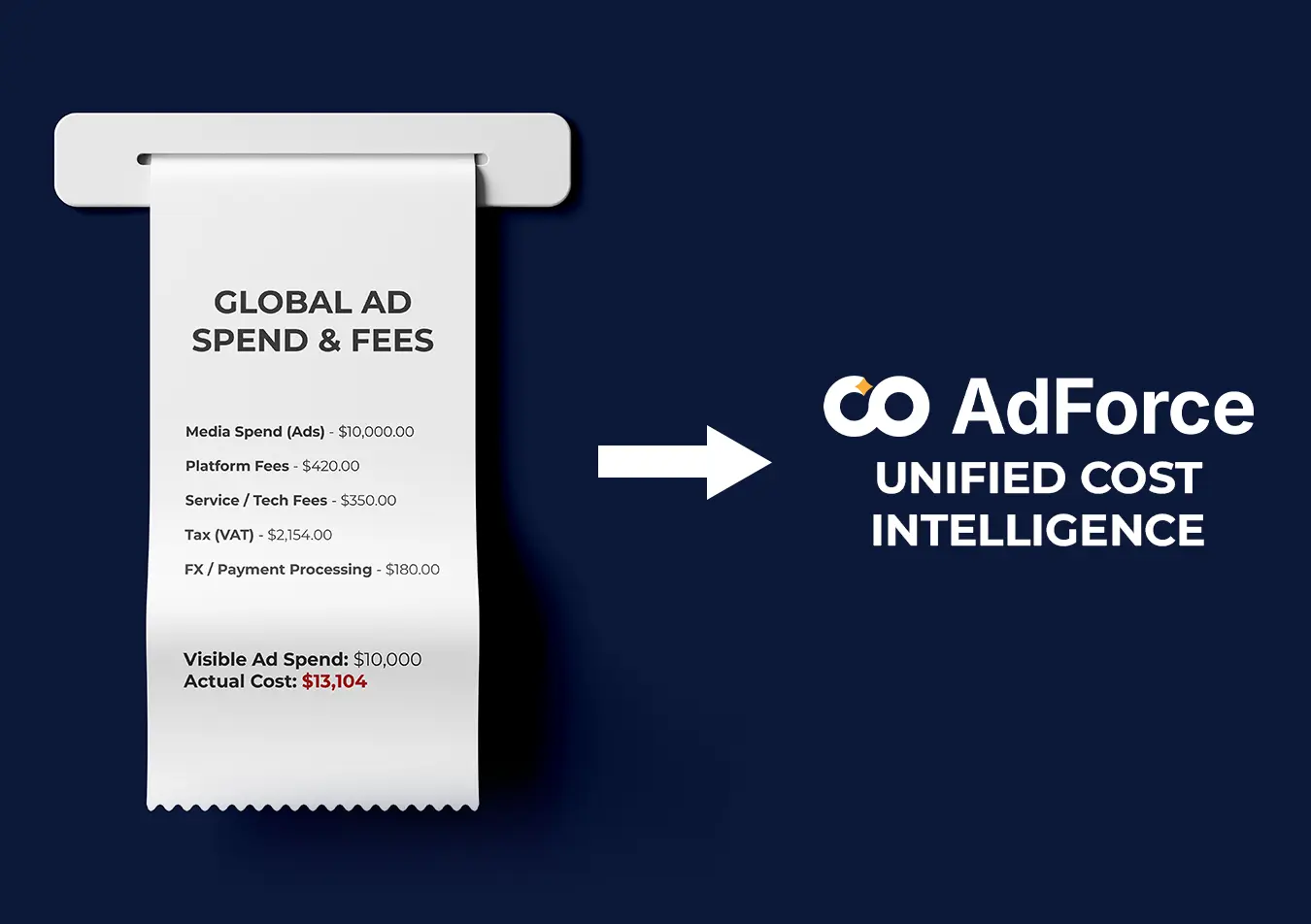

Tax and fee pass-throughs: Around the world, governments have begun imposing digital services taxes and VAT on online advertising. Meta typically passes these costs to advertisers. Depending on your country, you might be paying an extra 5-15% in taxes on top of your ad spend. For example, many EU countries require VAT on ads (unless you have a valid business VAT ID), and countries like India or Turkey have introduced special digital ad levies. A recent change in one major market added 12% in mandatory fees to Facebook ads (essentially overnight on Jan 1, 2026), instantly making Meta ads pricier for anyone targeting that region. These costs often fly under the radar because they appear in billing statements or invoices rather than in the Ads Manager dashboard. Advertisers not tracking these fees might wonder why their credit card is charged more than their campaign budget — that’s the hidden cost. Hidden fees are everywhere in digital advertising, from **platform markups, layered vendor fees, to added “optimization” charges, and they eat into your ROI if unchecked. (Meta’s case is usually taxes or currency conversion fees, rather than explicit markups, but the principle stands: you must account for every dollar that leaves your account.)

Meta’s policy and billing tweaks: Meta occasionally updates how it charges or how ads are delivered. One notable example: in early 2024, Meta announced a 30% surcharge for advertisers purchasing ads (boosted posts) through the iOS Facebook app. Why? Because Apple now takes a 30% cut of in-app transactions, so Meta decided to pass that cost to the advertiser rather than eat it. This policy meant small businesses who simply click “Boost post” on their iPhone suddenly paid 30% more for the same ad – a huge hidden cost if you weren’t aware. Meta’s recommendation (of course) was to use Ads Manager via web or the Meta Ads app to avoid Apple’s fee. The incident underscores how platform dynamics (Apple vs Meta) can trickle down to advertisers’ costs. It was a wake-up call: relying on a single channel or an easy boost can backfire with unexpected fees. Many DTC brands learned to adopt better infrastructure (like Business Manager or third-party tools) to avoid such platform taxes. Read this blog and check out what happened with Brazilian advertisers.

Meta has also played with billing models. In 2025, a Meta Help Center glitch suggested they might move to upfront billing for campaign budgets, charging your full budget when you launch, instead of as you accrue spend. Although Meta clarified this was a technical error and they didn’t implement the change, the very idea caused alarm among advertisers. Upfront billing would mean if your campaign under-delivers or you pause early, you might have already paid in full (and have to seek refunds). Even the possibility of that change highlighted an important point: advertisers need to be more careful about how and when Meta charges them. Knowing your billing thresholds, monthly invoice setups, or currency settings can save money. For instance, if your ad account is billed in a foreign currency, exchange rates and conversion fees could quietly add 1-3% to your costs.

Stricter policies, potential downtime: Meta’s advertising policies (e.g. on creative content, targeting, personal attributes) have gotten stricter. While this isn’t a “fee,” a policy violation can lead to ads being disapproved or accounts being restricted. The cost here is indirect: if your ad gets pulled mid-campaign, you might waste part of your budget with nothing to show, or you have to scramble with new creative (losing optimization progress). Policy changes such as limits on targeting certain demographics or the removal of certain ad placements can force you into potentially more expensive methods. For example, the removal of third-party data targeting (like Partner Categories a few years back) pushed many advertisers to rely on broader (and sometimes costlier) targeting. Each policy tweak can disadvantage those who don’t adapt.

To sum up, Meta’s platform changes and external policies can make ads more expensive even without you changing a thing. These are the “structural” costs: taxes, fees, billing policies, and rule changes. DTC brands scaling globally must stay on top of these to avoid nasty surprises. It’s wise to audit your ad invoices regularly and ensure you have infrastructure (like AdForce, for example) that gives you full spend visibility including taxes or any add-ons. In 2026, cost control isn’t just about winning the auction; it’s also about managing the fine print. The brands that do so will preserve more of their margin.

Inefficient Ad Infrastructure and Media Buying Setups

Sometimes the reason your Meta ads cost more is internal. The way you set up and manage campaigns can significantly affect performance and cost-efficiency. Poor ad operations or outdated media buying practices can lead to wasteful spending that isn’t obvious at first glance. In 2026, as Meta’s algorithms have evolved, the old manual, fragmented approaches can rack up costs. Let’s look at a few common inefficiencies:

Competing with Yourself (Audience Overlap): One of the most overlooked money-wasters is running ads that cannibalize each other. This happens when you have multiple ad sets or campaigns targeting similar audiences. For example, say you have one campaign targeting people interested in health and another targeting pet owners. Chances are, a lot of people fall into both groups. In Meta’s auction, if the same person is eligible to see ads from both campaigns, you’re essentially bidding against yourself for that impression. Meta doesn’t know you’re the same advertiser, so the bids go up. The outcome: higher CPMs and CPCs because of self-competition. You’re paying double to reach the same user. This overlap also splits your learning and data, making each campaign perform worse. Industry experts note that even a ~20-50% audience overlap can cause noticeable inefficiency, and anything above 50% is a serious waste of ad spend. The good news is it’s fixable by consolidating campaigns or using Facebook’s audience exclusion tools. In fact, when one e-commerce brand discovered a 65% overlap between two campaigns (website retargeting and Instagram engagers) and merged them, their cost per purchase dropped 37% in two weeks. This illustrates how better structure = lower costs.

Poor Funnel and Budget Structure: Meta’s algorithm today performs best with larger data sets and simpler structures. If you’re running a dozen tiny campaigns with small budgets, you might be underutilizing the algorithm’s learning capacity. Conversely, if you shove everything into one campaign without strategy, you might be mixing signals. The inefficiency shows up as either an unnecessarily high cost per conversion (because each campaign is “learning” slowly and showing ads to suboptimal users) or as limited scale (because budgets are siloed). Modern best practices encourage using broader audiences, consolidated campaigns (e.g., Advantage+ Shopping campaigns for e-commerce), and letting Meta’s AI optimize within a defined framework. Advertisers clinging to old tactics like very granular ad set segmentation or excessive manual bidding often find themselves paying a premium for lower results. It’s like driving a car in first gear: you burn fuel and go slow. By updating your “ad infrastructure”, meaning your account structure, data integrations, and tools, you can get more mileage for the same spend.

Weak Tracking and Data Integration: Infrastructure also means your technical setup. If you haven’t implemented the Meta Pixel properly, or the Conversions API (CAPI), you might be losing conversion data. That means Meta’s algorithm isn’t seeing some of your sales, leading it to optimize less effectively (and possibly thinking your ads are performing worse than they are). For example, if 15% of your purchases aren’t tracked due to browser restrictions and you haven’t set up CAPI to send those events from your server, Meta might spend budget in the wrong places or exit the learning phase slower. That translates to higher CPA. Similarly, not feeding back offline conversions or failing to verify domains (post-iOS14 requirements) can limit the system’s effectiveness. These are infrastructure issues that indirectly hike your costs by hurting performance.

Lack of Spend Visibility and Controls: Many growing brands run multiple ad accounts (for different regions or lines of business), and possibly other platforms too. Without a centralized view, it’s easy to miss waste and hidden costs. For instance, two different team members might promote the same product to overlapping audiences in different campaigns, a coordination issue. Or you might not notice a frequency creeping up, or a certain placement draining budget with poor results. This is where having an integrated tool or dashboard (like those provided by AdForce) becomes valuable. It can surface anomalies and ensure you’re not leaving campaigns on autopilot that burn money. Essentially, good infrastructure catches inefficiencies early.

Over-reliance on Boosting and Basic Tools: This is common with small in-house teams: using the one-click “Boost post” or simplified campaign setups. As mentioned earlier, boosting through the app even carried an extra fee on iOS (30% more cost). But beyond fees, boosting posts without the full power of Ads Manager often means limited optimization options. You might be paying more for a broad objective (like engagement or very general targeting) versus using a proper conversion campaign with refined goals. It’s a classic case of convenience leading to suboptimal spend. Brands that outgrow the “boost” phase and invest in professional ad management usually see their CPAs drop because they can better refine who they reach and how.

Your internal ad setup matters greatly for cost efficiency. Many Meta cost woes are avoidable by tightening up how you run campaigns. Don’t pay the “novice tax” – e.g., bidding against yourself or underutilizing automation. Simple fixes like consolidating overlapping audiences and implementing proper tracking can yield immediate cost reductions (30%+ improvement in some cases). The larger lesson for 2026 is that as advertising gets more complex, investing in ad operations infrastructure is no longer optional. Whether that means hiring experienced media buyers, using advanced rules in Ads Manager, or leveraging an adtech platform like AdForce for spend management, the goal is the same: eliminate inefficiencies. In a year where every extra dollar counts, fixing internal leaks in your ad spend can be the fastest way to improve ROI.

Bad Data, Wrong Decisions, Lost Profit

Finally, let’s discuss a trio of related factors that can make Meta advertising seem more expensive, and in many cases actually make it more expensive if not addressed. These are a bit more complex: Wrongly tracked results, the cost of constant creative testing, and misdiagnosing profit margins. Together, they often create a vicious cycle for in-house media buyers: you keep switching strategies or pouring money into new creatives, and still feel like you’re chasing your tail. Here’s why.

The Attribution Black Box: Attribution is how we credit sales or conversions to ads. Ever since the privacy changes mentioned earlier, attribution on Meta has become an educated guess. Meta’s reported ROAS (return on ad spend) might undervalue or miss a lot of real revenue that your ads influenced. As Digiday noted, after iOS14 “the effectiveness of ads hasn’t necessarily gone away… but it has become more difficult to know how effective those ads are”. This has huge psychological and practical impacts on marketers. If your dashboard shows a 0.5x ROAS (i.e. you’re spending more than revenue coming directly from ads), you might panic and cut spend – even if in reality, many of those customers purchased a week later through an email (thanks to the ad warming them up). Conversely, if Meta over-credits conversions through modeled data, you might think a campaign is doing better than it truly is. Misattribution leads to misallocation: scaling the wrong ads or turning off the right ones. Either mistake can increase your costs (by either wasting budget on non-performers or missing opportunities and then paying more to reacquire lapsed customers).

A common scenario: Advertisers see a drop in tracked conversions and an increase in CPA on Meta, so they attempt more testing or shift budget around, thereby incurring more costs to “find what works”. You end up stuck in a cycle, spending money based on the wrong signals. As one marketer put it, “Across the board, we noticed holes in our data, which painted a different picture than the bottom line”, leading them to seek other attribution solutions and double down on creative testing. In plain terms, when you can’t trust the numbers, you end up trying a bit of everything, an expensive proposition.

Creative Testing Loops: Creative is king on Meta now: with broader targeting, the ad creative (visuals, copy, offer) does the heavy lifting to attract the right customers. It’s absolutely true that testing new creatives is essential to keep performance up and find winners. However, creative testing has a cost. Every new ad you test requires spend to reach statistical significance. If you lack a solid testing framework, you can burn thousands on experiments that go nowhere. Some brands fall into a pattern of “new week, new creative” because performance is volatile. Without learning from each test, this just becomes a money pit. Ideally, you want to test systematically: isolate variables, use a portion of budget for testing and the rest on proven ads. Advertisers who don’t do this end up in constant reactive mode launching ads to chase yesterday’s results. This can inflate costs in two ways: (1) Inefficient spend on too many test ads that never get the chance to optimize fully, and (2) potentially missing out on giving the algorithm stability (frequent creative resets can keep you in the learning phase).

Now, creative testing is not bad: it’s necessary. The point is that without data-driven insights, it can be excessive. For example, one source suggests successful brands allocate about 10-15% of their budget to structured creative testing, so it’s enough to learn but not so much that it drains the whole budget. Moreover, using tools (or methodologies) to analyze creative performance can help avoid wasting budget on ineffective ads by learning quickly. If you find a winner, you can scale it and pause the duds faster, thus controlling costs. In 2026, AI tools can even predict creative performance (through computer vision, etc.), which might reduce the trial-and-error cost. The bottom line is, if you feel stuck in an endless test loop, stepping back and implementing a clear testing strategy will save money.

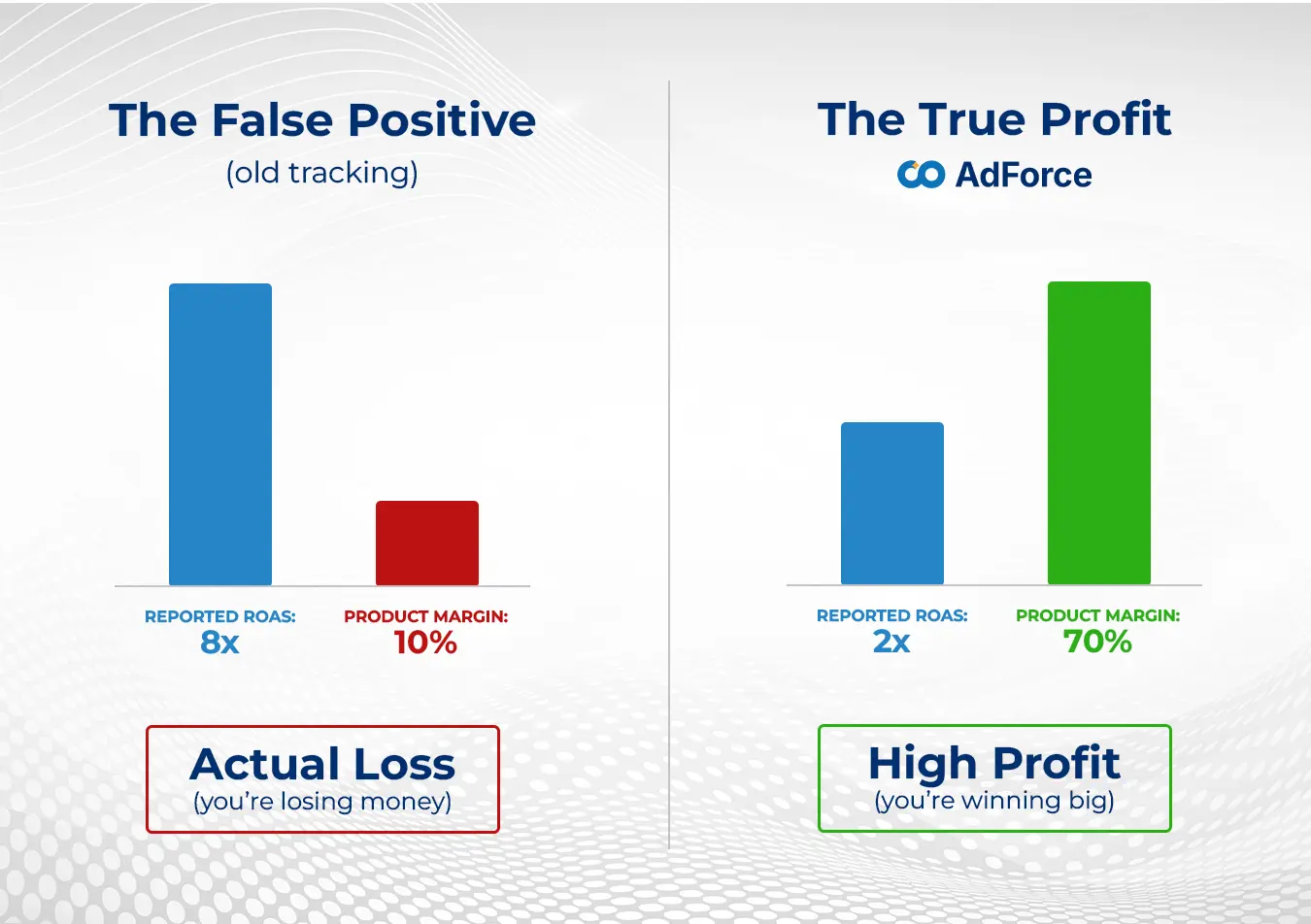

Margin Misdiagnosis (ROAS vs Profit): Perhaps the most important factor for a brand’s sustainability is understanding profit, not just ad metrics. Many DTC brands chase a target ROAS or CPA without connecting it to their actual product margins or lifetime value (LTV). This can lead to what we’d call margin misdiagnosis: you think your ads are “too expensive” or “doing great” purely based on ROAS, but you’re misreading the real profit impact. For instance, if you have a 50% gross margin on your product, a 2:1 ROAS (or 50% CPA as a percent of sale) is roughly break-even. Anything less and you’re losing money on the first sale; more and you’re profitable. If a brand doesn’t factor this in, they might either overspend (because a 3:1 ROAS looks good superficially, even if it’s barely profitable after costs), or they might pull back on campaigns that are, in fact, net-profitable when you account for customer LTV or upsells.

In 2025, the industry started actively debating “ROAS vs. profitability” as the key metric, with a clear consensus that ROAS does not equal profit. A high ROAS can mask thin margins and create an illusion of success while actually undermining your bottom line. For example, you could have an 8x ROAS on a product with 10% margin – you’d still be losing money after fulfilling the orders! On the flip side, a 2x ROAS on a high-margin or subscription product might be very healthy for growth. The message: Don’t diagnose your ad performance in isolation from unit economics. In the context of Meta costs, many advertisers say “Meta ads are getting too expensive, my ROAS is down” without digging into whether their customer acquisition cost is actually acceptable relative to lifetime value. Sometimes the issue isn’t that Meta ads became more expensive – it’s that your business needed a higher ROAS than before (maybe due to rising product costs, etc.). Or, perhaps your ROAS is down but you’re acquiring more valuable customers. These nuances matter. The most sophisticated DTC marketers now focus on blended metrics like LTV:CAC, payback period, and net profit per customer rather than just platform ROAS.

Advertisers must change how they measure success to truly understand costs. Misattribution and ROAS obsession can lead you to think Meta ads aren’t working and either overspend in the wrong areas or cut the right spend (both scenarios waste money). Break the cycle by focusing on real business metrics: profit, LTV, and incremental lift. Accept that in 2026, Meta’s reporting might undervalue your ads, so use tools or models to fill the gap (as some did by using third-party attribution and seeing the fuller picture). Additionally, be methodical with creative testing: it’s essential, but it should be optimized itself. Each test should have a hypothesis and a learning goal; otherwise you’re just burning cash on randomness.

To truly combat these issues, many brands are investing in better analytics and infrastructure. For example, AdForce’s platform is designed to give holistic spend and performance visibility, connecting ad data with sales data, so you can see true ROI and not get misled by incomplete platform metrics. This kind of modern ad infrastructure helps pinpoint where your Meta ads are delivering profitable growth versus where they’re just draining budget. It’s this clarity that lets you break out of misattribution doom loops and make decisions that protect your margins.

Basically: Control Costs with Smarter Infrastructure in 2026

Meta advertising in 2026 is a more challenging game than it was a few years ago. Costs are higher due to auction competition, data is scarcer due to privacy, platform tweaks add their own toll, and operational missteps can quietly burn through your budget. For brands and performance marketers, the question isn’t “can we avoid these rising costs?” – it’s how do we reduce them and still grow?

The silver lining is that each challenge comes with a strategy or tool that can counteract it.

In summary, Meta ads are more expensive in 2026, but they don’t have to sink your marketing plans. By understanding why costs have risen, you can adapt your strategy and toolset to fight back. Think of it like navigating with a sharper compass: each challenge, from auction inflation to attribution woes, can be met with smarter navigation. The brands that thrive will be those who invest in robust ad infrastructure and data-driven strategy, turning what others see as “rising costs” into an opportunity to out-optimize the competition.

In the end, controlling advertising costs today is less about trying to pay Facebook less and more about building a smarter machine around your advertising. Modern ad infrastructure is becoming the key to cost control and efficient scaling. By plugging leaks, illuminating hidden expenses, and focusing on meaningful metrics, you can make every Meta ad dollar work harder for you. Platforms like AdForce exist to empower this approach, unifying your spend, performance, and margins in one place, so you’re not flying blind. As we move further into 2026, one thing is clear: the era of easy wins in paid social is over, but with the right strategy and infrastructure, sustainable wins are still very much on the table.